TheCreditWatcher is a website that gives you free credit scores from all three bureaus.

After entering basic information online, you can get free credit scores, giving you valuable insight into your financial health. After receiving your credit scores, you receive ongoing credit monitoring from TheCreditWatcher, protecting you 24/7 against erroneous credit report entries.

Is TheCreditWatcher another credit check scam? How does TheCreditWatcher work? Keep reading to find out everything you need to know about TheCreditWatcher.com

What is TheCreditWatcher?

TheCreditWatcher is a credit check website found online. The website gives you free credit scores from all three credit score bureaus in the United States, including TransUnion, Equifax, and Experian.

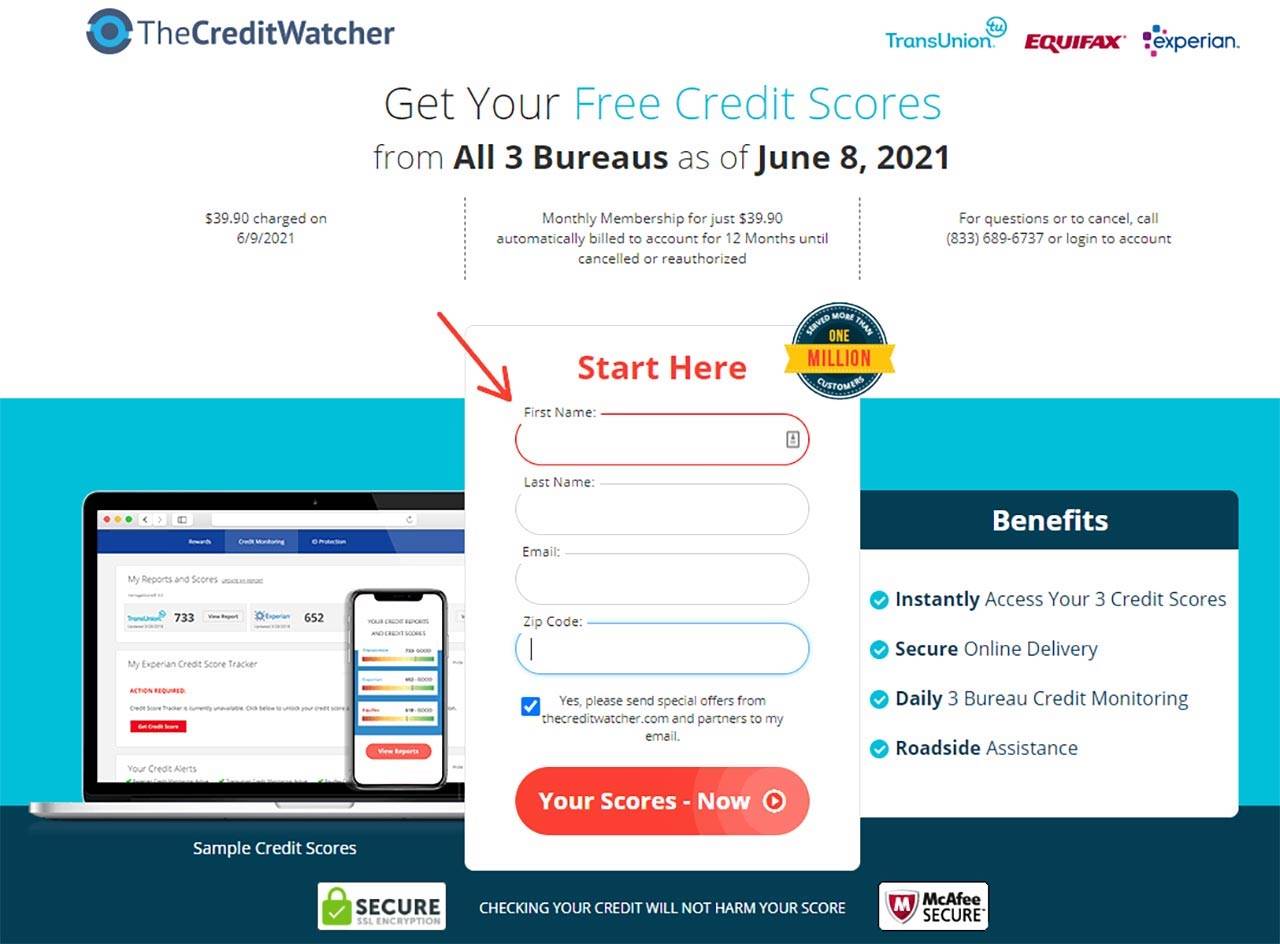

After entering your basic information into the TheCreditWatcher website, you can instantly access your three credit scores. The website uses a secure online delivery system.

After receiving your three free credit scores, you automatically sign up for daily credit monitoring through TheCreditWatcher. In exchange for a monthly fee of $39.90, you receive daily credit monitoring, alerting you to any sudden or mysterious changes to your credit report. The first charge occurs the day after you submit a request. Your subscription also comes with roadside assistance, protecting you from unexpected events while driving.

You can cancel your membership to TheCreditWatcher at any time to avoid all future monthly membership fees. However, the company does not provide a refund on any purchases. In other words, you can check your credit scores from all three bureaus, instantly online, for a one-time fee of $39.90 (assuming you cancel your TheCreditWatcher membership within 30 days).

TheCreditWatcher Features & Benefits

TheCreditWatcher emphasizes all of the following features and benefits:

- Secure online delivery

- Instantly access your three credit scores, including your credit scores from TransUnion, Equifax, and Experian

- Daily, 24/7 credit monitoring across all three credit bureaus

- Alerts about changes in your credit

- Social Security Number monitoring

- Access to the credit education center

- Identity theft protection

- Roadside assistance

How Does TheCreditWatcher Work?

TheCreditWatcher works similar to other credit check websites. You enter basic information into the online form. Then, you receive credit scores from all three major credit bureaus in the United States.

First, you enter your information into the website. Type in your name, email address, and ZIP code.

Then, enter the last four digits of your Social Security Number. TheCreditWatcher uses your SSN to match your identity with your credit report. Your Social Security Number is a unique, nine-digit number assigned by the government. By matching the last four digits of your SSN with your first name, last name, and address, TheCreditWatcher can pull your credit report from the three bureaus.

TheCreditWatcher also asks for your date of birth, a username, and a password for your account.

Note: If TheCreditWatcher is unable to verify your information using the last four digits of your SSN, then the website will ask for your full 9-digit Social Security Number.

Then, the website verifies your personal information. It checks with the three credit bureaus to verify your personal information is correct and matches your credit record.

Once the verification is complete, TheCreditWatcher provides instant access to your credit scores.

TheCreditWatcher Credit Monitoring

Most people use TheCreditWatcher to instantly check their credit scores online. TheCreditWatcher provides three free credit scores from TransUnion, Equifax, and Experian (one credit score from each bureau).

However, your subscription (priced at $39.90 per month) also includes credit monitoring. TheCreditWatcher claims to monitor your credit daily, helping you spot unusual activity before it impacts your credit score.

Here’s how the TheCreditWatcher’s credit monitoring services work:

- TheCreditWatcher’s credit monitoring monitors one or more of your credit files, depending on the type of credit monitoring that may be offered to you.

- The credit monitoring service may be owned and/or maintained by each of the applicable credit bureaus, including TransUnion, Experian, or Equifax

- Credit monitoring monitors the credit file most closely identified with you based on multiple identifying factors, including your first, middle, and last names, current and former addresses, Social Security Number, and date of birth, among other information

- By regularly monitoring your credit report, TheCreditWatcher can help you spot erroneous information and remove it before it impacts your financial future.

TheCreditWatcher appears to exclusively partner with TransUnion, Experian, and Equifax for credit monitoring services. Instead of (or in addition to) providing their own credit monitoring services to customers, TheCreditWatcher provides credit monitoring offers to customers from one or more of these credit bureaus.

What’s Included with TheCreditWatcher?

Your subscription to TheCreditWatcher includes all of the following:

24/7 Credit Monitoring & Identity Theft Protection

Like other credit monitoring services, TheCreditWatcher tracks your credit 24 hours a day, 7 days a week, looking at your credit score for any unusual changes. If someone uses your SSN to take out a credit card or auto loan in your name, for example, then TheCreditWatcher could spot it and alert you, preventing the entry from negatively affecting your credit score.

Alerts About Changes in Credit

You receive alerts whenever there’s a change in your credit score. If you missed a payment on your bills, for example, then your credit score may drop a few points. If you reduce your debt or made another on-time credit card payment, then your credit score could increase. TheCreditWatcher keeps you updated on how much your credit score has changed over time.

Access to Credit Education Center

Your subscription to TheCreditWatcher includes access to the Credit Education Center. This education platform teaches you more about your credit, your credit score, and your credit reports. You can discover how to improve your credit, remove false entries on your credit report, and maximize your financial health by optimizing your credit.

Social Security Number Monitoring

TheCreditWatcher monitors your credit score by looking for entries that use your Social Security Number. If your SSN has been compromised, then someone may use your SSN to apply for credit cards, auto loans, car insurance, banking services, and more. TheCreditWatcher monitors your Social Security Number 24/7 to avoid any unexpected entries.

Roadside Assistance

According to the official website, your subscription to TheCreditWatcher includes roadside assistance. Roadside assistance covers unexpected emergencies while driving, including flat tire changes, vehicle lockouts, fuel delivery, towing, breakdowns, and more. Roadside assistance plans vary in coverage, but most cover incidents up to certain limits – say, 10 miles of towing 2 gallons of gas, or $75 to $150 per service call.

What’s the Catch?

All three credit bureaus in the United States provide free credit scores to consumers upon request. Consumers are entitled to one free credit report every year from TransUnion, Equifax, and Experian. You can contact these companies directly to receive your free credit report. Most companies mail the credit report to you. Some provide the credit report to you online immediately for an extra fee.

When you use a service like TheCreditWatcher, you receive instant access to the free credit score you can normally receive through TransUnion, Equifax, and Experian. Instead of waiting for these credit bureaus to mail the score to your address, you receive instant access through TheCreditWatcher’s online portal.

In exchange for providing instant access to your credit score, TheCreditWatcher charges a monthly membership fee of $39.90.

This payment is automatically billed to your account for 12 months, equalling total payments of $478.80. Payments continue until you cancel (ending payments immediately) or reauthorize (continue paying payments after the 12 months ends).

TheCreditWatcher is not a scam: the company discloses all fees and charges upfront. As far as we can tell, you’re free to cancel your credit monitoring subscription after your first payment of $39.90. If you don’t cancel your subscription, however, then the company will continue charging you a fee of $39.90 for the next 12 months, at which point your subscription automatically ends.

Why Check My Credit Score?

Your credit score plays an important role in financial decisions. A good credit score paves the way towards competitive interest rates for mortgages, cars, credit cards, insurance premiums, and even job offers. Many are surprised at the number of doors that open when they have a strong credit score.

On the flip side, a bad credit score – or no credit score – can bring financial hardship. People with bad credit scores have higher insurance premiums, fewer job offers, higher car payments, worse credit card offers, and poorer mortgage terms. Companies may even deny your requests for all of these things because of your poor credit score.

Regular credit monitoring helps you maintain a good credit score. When you regularly monitor your credit, you can identify problem areas and fix them. Many are surprised to discover erroneous information on their credit reports, which is why they fix or remove certain entries after checking their credit report.

TheCreditWatcher Pricing

TheCreditWatcher is priced at $39.90 per month. You are automatically signed up for a 12-month subscription upon registering for the website’s credit monitoring services.

The company may provide you with offers for additional credit monitoring services through TransUnion, Experian, and Equifax. These credit monitoring services may cost an additional fee.

You can monitor all TheCreditWatcher billing through the online Billing History section of My Account.

TheCreditWatcher Cancellation & Refund Policy

You can cancel your TheCreditWatcher subscription or membership at any time by calling the company at their toll-free number, (833) 689-6737.

You can also use the contact information provided on the website. Or, you can cancel online through the customer portal, located in the Billing History section of My Account.

If you cancel your TheCreditWatcher membership, you will no longer be billed for credit monitoring services. However, you will have access to the service until the end of your subscription or membership period.

Here’s how the company explains its cancellation policy, according to the terms and conditions:

“You may cancel your membership or subscription at any time by calling us at the toll free number (833) 689-6737 or by using the contact information provided on the Website – OR- by cancelling online in the customer portal, located in the Billing History section of My Account.”

The company does not issue refunds or credits on payments you have already made, nor do they provide prorated refunds.

TheCreditWatcher recommends canceling your subscription at least three business days before your next billing date to avoid future charges.

About VegData Corp.

TheCreditWatcher is run by a Las Vegas, Nevada-based company named VegData Corp.

According to Nevada corporation registration data, VegData was launched on November 14, 2019. The corporation was registered by Joshua Tatum, who is also listed as the President, Secretary, and Treasurer of the company.

VegData Corp appears to be associated with other credit monitoring websites, including TheCreditProtect.com.

You can contact VegData Corp and the TheCreditWatcher customer service team via the following:

- Email: support@thecreditwatcher.com

- Phone: (833) 689-6737

- Mailing Address: 10192 S Maryland Pkway, Ste 1015, Las Vegas, NV 81982

- Hours: Mon – Fri 9 am to 9 pm EST, Sat 9 am to 4 pm EST, and Sun 1 pm to 6 pm EST

TheCreditWatcher Final Word

TheCreditWatcher is a credit check website found online. The website allows you to instantly access your three credit scores, including your free credit scores from TransUnion, Equifax, and Experian, the three main credit bureaus in the United States.

In exchange for accessing your credit reports through TheCreditWatcher, you pay a fee of $39.90 per month. You can cancel your subscription at any time to stop all future payments.

To learn more about TheCreditWatcher and to discover your credit scores online, visit the official website today.

More Like This: Best Credit Repair Companies 2021 Top Online Services to Use

Affiliate Disclosure:

The links contained in this product review may result in a small commission if you opt to purchase the product recommended at no additional cost to you. This goes towards supporting our research and editorial team and please know we only recommend high quality products.

Disclaimer:

Please understand that any advice or guidelines revealed here are not even remotely a substitute for sound medical advice from a licensed healthcare provider. Make sure to consult with a professional physician before making any purchasing decision if you use medications or have concerns following the review details shared above. Individual results may vary as the statements made regarding these products have not been evaluated by the Food and Drug Administration. The efficacy of these products has not been confirmed by FDA-approved research. These products are not intended to diagnose, treat, cure or prevent any disease.