A panel of the Alaska Senate has taken its first, reluctant, look at a proposal to revive the state’s income tax.

In a series of hearings that stretched into the night, the Senate Labor and Commerce Committee examined House Bill 115, which passed the House of Representatives earlier this month.

HB 115, if passed by the Legislature, would impose a progressive income tax on Alaska for the first time since 1980. It would generate $687 million per year once fully implemented in 2019.

The coalition majority that runs the Alaska House has named the income tax one of the “four pillars” needed to eradicate Alaska’s $2.8 billion annual deficit.

Pillars two through four are modest budget reductions, spending from the Alaska Permanent Fund, and cuts to the state subsidy of oil and gas drilling.

All but the income tax and cuts to the drilling subsidy are already headed to negotiations between the House and Senate, and the subsidy cut will be in the same position soon.

Senate President Pete Kelly, R-Fairbanks, and other members of the Senate’s Republican-led majority have said they are adamantly opposed to an income tax.

“The only thing standing between you and an income tax is the Senate,” Kelly said in an opinion column published in the Empire on Sunday.

Nevertheless, the Senate is examining the idea before it discards the notion.

Speaking to the Senate committee on Tuesday, state revenue director Ken Alper said much of the income tax will come from wealthy Alaskans.

“Based on our analysis, we estimate between 35-40 percent of total tax receipts will come from households who earn more than $250,000 per year,” he said.

According to figures provided by Alper, about 14,000 Alaska households earn more than $200,000 per year. Of those, 110 Alaskans earn more than $1 million per year, and 520 couples earn more than $1 million per year combined.

Sen. Berta Gardner, D-Anchorage and a minority member of the Labor and Commerce Committee, asked Alper to repeat himself for emphasis.

Other members of the committee remained skeptical of the idea and concerned about the tax’s effect on the Alaska economy, which is entering its second year of recession.

Alper admitted that a tax would pose a “drag” on the economy.

“That’s just the nature of increasing taxation,” he said.

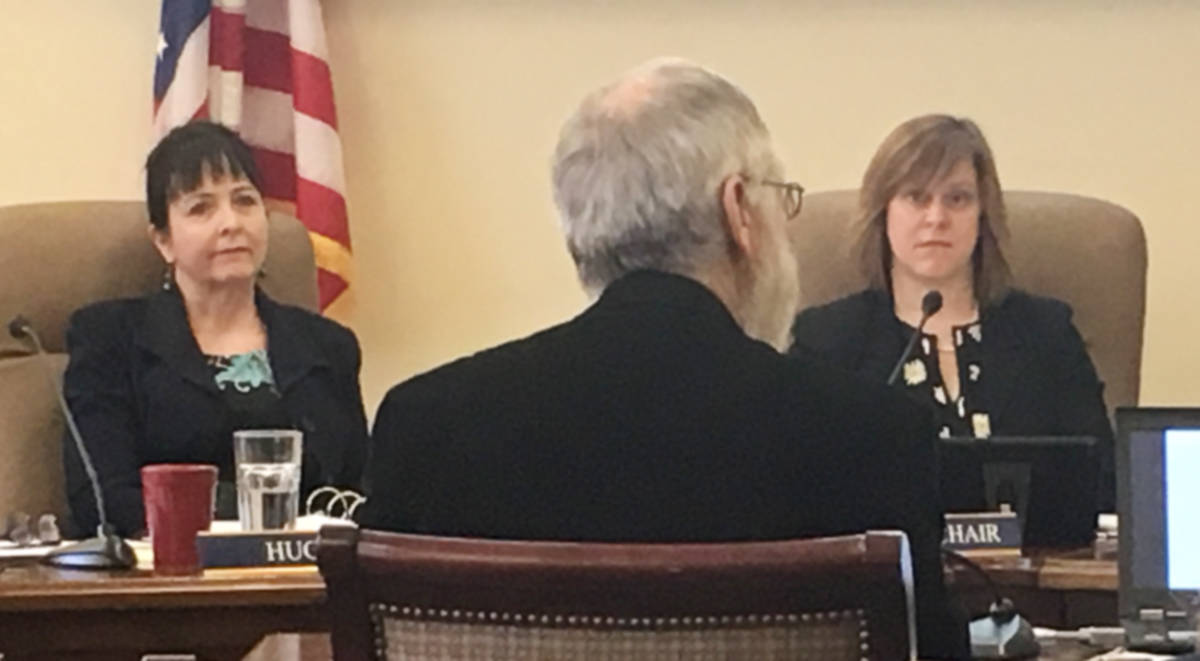

Sen. Shelly Hughes, R-Palmer, said in committee that she was concerned with the tax’s effect on small businesses and added in a morning hearing that she has heard from many constituents adamantly opposed to the idea of an income tax.

“This has awakened a sleeping giant in my district, I will tell you,” she said.

In a prepared statement, Sen. Mia Costello, R-Anchorage and chairwoman of the committee, said, “I am personally opposed to an income tax, and more so after hearing the details surrounding this proposal by the House.”

In committee, Sen. Kevin Meyer, R-Anchorage, referred to the Senate’s own budget plan.

That plan calls for steep cuts and spending from the Permanent Fund to partially erase the deficit.

Unlike the House plan, the Senate proposal doesn’t completely eliminate that deficit, but Meyer said that’s not a problem.

“In the Senate, we like that little bit of deficit. It keeps the pressure on us to keep the spending down,” he said.

Additional Senate hearings on HB 115 are scheduled for Wednesday.

• Contact reporter James Brooks at james.k.brooks@juneauempire.com or call 419-7732.