The current budget year is off to a strong start, but next year will see many changes and firsts as local leaders enter the beginning stages of crafting a spending plan, Juneau’s new finance director told Assembly members Wednesday.

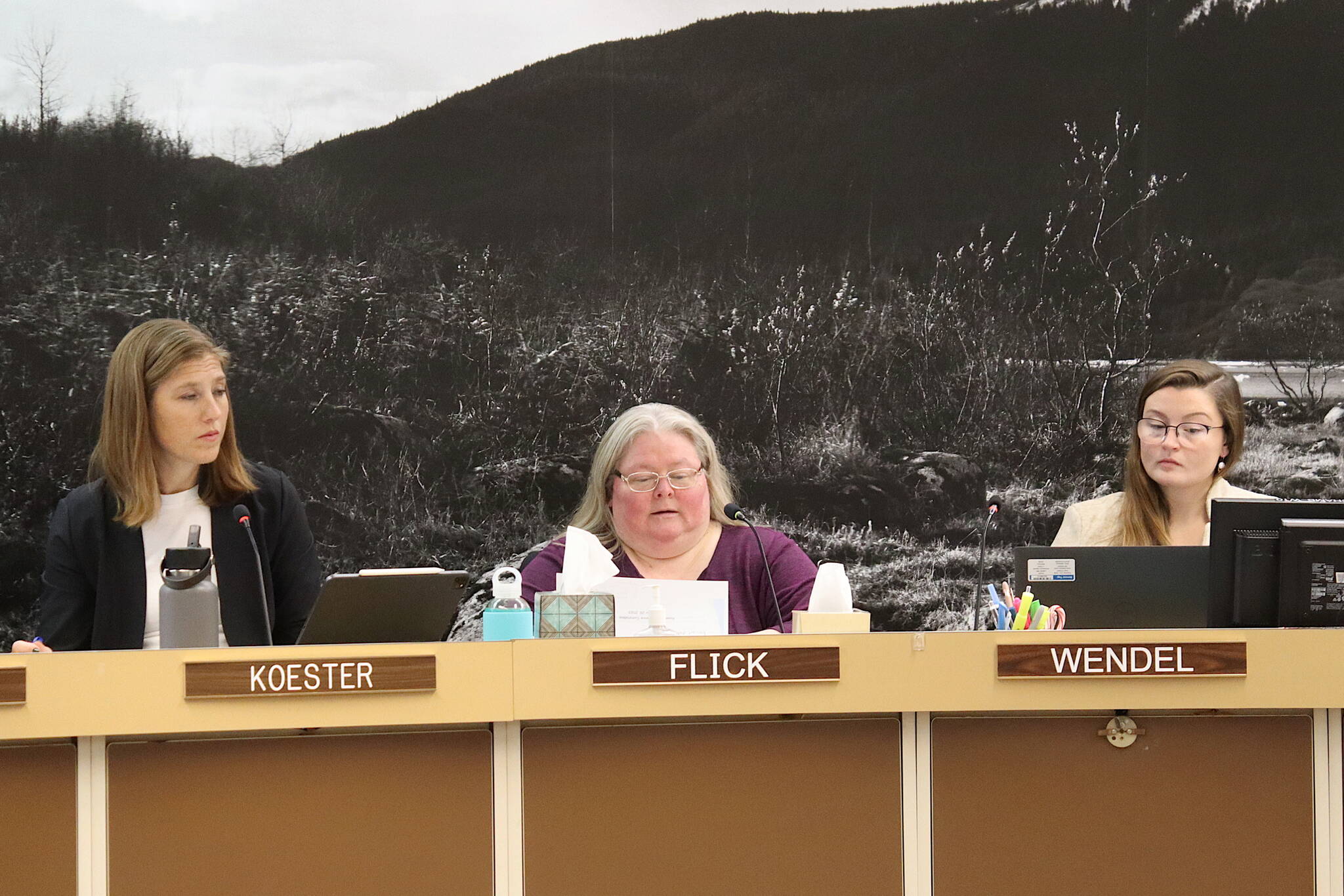

A lot of uncertainties also lie ahead that won’t be known for months, ranging from what happens with inflation to the collective guidance Assembly members provide budget staff about priorities for the fiscal year that starts next July 1, City and Borough of Juneau Finance Director Angie Flick said during an Assembly Finance Committee meeting. Because of that, she emphasized the numbers in the proposal for next year’s budget are meant only as a starting point for the upcoming discussions.

Assembly members, along with many city administrators and staff, are scheduled to discuss their budget goals and other topics during a daylong retreat Saturday in the Alaska Room at Juneau International Airport. The retreat is open to the public, but public testimony will not be taken.

The “very draft” budget of about $190 million, based on a status quo approach by the city, contains a deficit of about $1 million that would require the property tax rate to be raised to 10.28 mills compared to the current 10.16 rate, based on property values increasing 2.5%, Flick said.

However, “it is too early to know the valuation of properties yet for property tax projections, however a 2.5% increase in values was used as a placeholder,” Flick noted in a written overview of the draft budget presented to the Assembly.

The draft budget also assumes a 3.5% to 3.7% inflation rate and expects revenue sales taxes to increase by about that amount, but “a more conservative increase of 2.5% was applied to revenue collected via general fund programs (such as) permits, participation fees, and the like,” according to Flick’s overview. A 2% increase in city employee wages is forecast to comply with collective bargaining agreements, along with a 5% increase in employer-paid benefit costs.

Even if the city did incur a $1 million deficit during the coming fiscal year it would still have about $50 million remaining in cash, including $30.4 million in unrestricted general funds as well as $19.6 million in restricted reserve funds, according to Flick’s initial projections. However, the city is required to pass a balanced budget each year and Flick reminded Assembly members the general fund balance should be used for other purposes.

“You should use them for one-time projects and expenditures rather than ongoing expenditures,” she said. “It is a good use of a fund balance to take care of efforts you are going to have to do anyway…and also anything that might reduce our operating expenses going forward.”

Flick also reviewed the previous year’s budget as well as the current year to date, reporting strong numbers for both.

Last year, for instance, she said sales tax revenue was about $11 million instead of the roughly $7 million projected and the city earned $6 million in investment income despite a lot of skepticism when that budget was adopted.

“If you’ll remember how volatile that year was, no one was feeling great about budgeting anything for investment,” she said. “So our investment portfolio really had a much better year than anybody anticipated.”

During the first three months of the current fiscal year the city has collected about $500,000 more in sales tax than expected — a period that occurred during a record cruise ship season — but “I would not anticipate that kind of variance in the winter months,” Flick said.

Looking ahead to next year there are a variety of fiscal and societal issues Assembly members will have to grapple with as they construct a direction for finance staff to follow in crafting a budget that is ultimately approved, Flick wrote in her overview.

“The CBJ is plotting a course through returned tourism, housing issues, aging infrastructure, continuing struggles with recruiting and retaining employees, as well as mitigating the impacts of mother nature and balancing the needs of both an aging population and a workforce population,” she wrote in her analysis.

Flick, who is going through her first cycle as the city’s budget director after replacing Jeff Rogers who departed for Oregon this spring after overseeing four years of budget cycles, said “I don’t think there were any large differences in philosophies or process” in her preliminary proposal for next year.

But there is one significant difference everyone involved in the budget process will likely have to adjust to as the large financial spikes — good and bad — resulting from the COVID-19 pandemic, appear to be over, Flick said.

“I think we’ve reached the end of anomalous one-time revenue sources falling on CBJ,” she said. “So I think one of the right things from a forecasting perspective is we can go back to kind of those tried-and-true look at history, look at a few economic variations that are going on, and get more precise for our forecasting.”

“It was really hard for anybody to do accurate forecasting during the pandemic where you had anomalous behavior, tons of money coming from the feds (and) from the state — it made it really, really hard to guess what was happening on the different spikes and retreats of the COVID disease. So I’m excited that it looks like the very large one-time swings in our revenue and expenditures are hopefully going away, and we can get back to more incremental-type changes.”

• Contact Mark Sabbatini at mark.sabbatini@juneauempire.com or (907) 957-2306.