With online shopping expected to spike amid the holiday shopping season, so will cybercrime and scams.

“With the holidays coming up and seasonal shopping in full swing, the FBI wants to remind the public that criminals are also gearing up for a busy season,” said Chloe Martin, public affairs officer for the FBI’s Anchorage field office, in an email. “Criminals do not take the holidays off, and shoppers should be more vigilant than ever for scams designed to steal their money and personal information.”

Martin said generally the types of scams do not drastically change, but the techniques and methods deployed by scammers do vary.

“We’ve found that criminals are often aggressive and creative in their efforts,” Martin said, “but there are certain red flags and best practices that holiday shoppers can guard against this holiday season.”

The FBI outlined several types of scams that folks may encounter this time of year and best practices for safe online behavior.

Online shopping scams

If it seems too good to be true, there’s a good chance it is, according to the FBI.

Scammers often offer what seem to be incredible deals via phishing emails or advertisements. That might mean brand-name goods at extremely low prices or gift cards as an incentive.

The FBI advises steering clear of untrustworthy sites or ads offering items at unrealistic discounts or with special coupons. People may pay for an item that never comes and give away personal information and credit card details.

People should be vigilant when receiving items purchased from online auctions and third-party marketplaces, according to the FBI. If an item arrives from another online merchant, it may have been purchased using a stolen credit card number, stolen rewards points or other unlawful means. These cases should be reported to both the marketplace where the item was purchased and to the merchant who sent it.

[Juneau woman arrested on fraud charges]

Advanced fee schemes are another common scam. In these schemes, a deposit is requested to reserve a vacation, cruise, at-home job or another much-wanted item, according to the FBI. Puppy purchase scams are an increasingly prevalent advance-fee/online shopping scam, especially during the holidays. Fraudsters use social media or other websites to offer puppies for sale and take money but never deliver the animal.

Social media scams

People should beware of posts on social media sites that appear to offer vouchers or gift cards, according to the FBI. These posts may appear as holiday promotions or contests or from known friends who have shared the link. Often, these scams lead consumers to participate in an online survey that is actually designed to steal personal information.

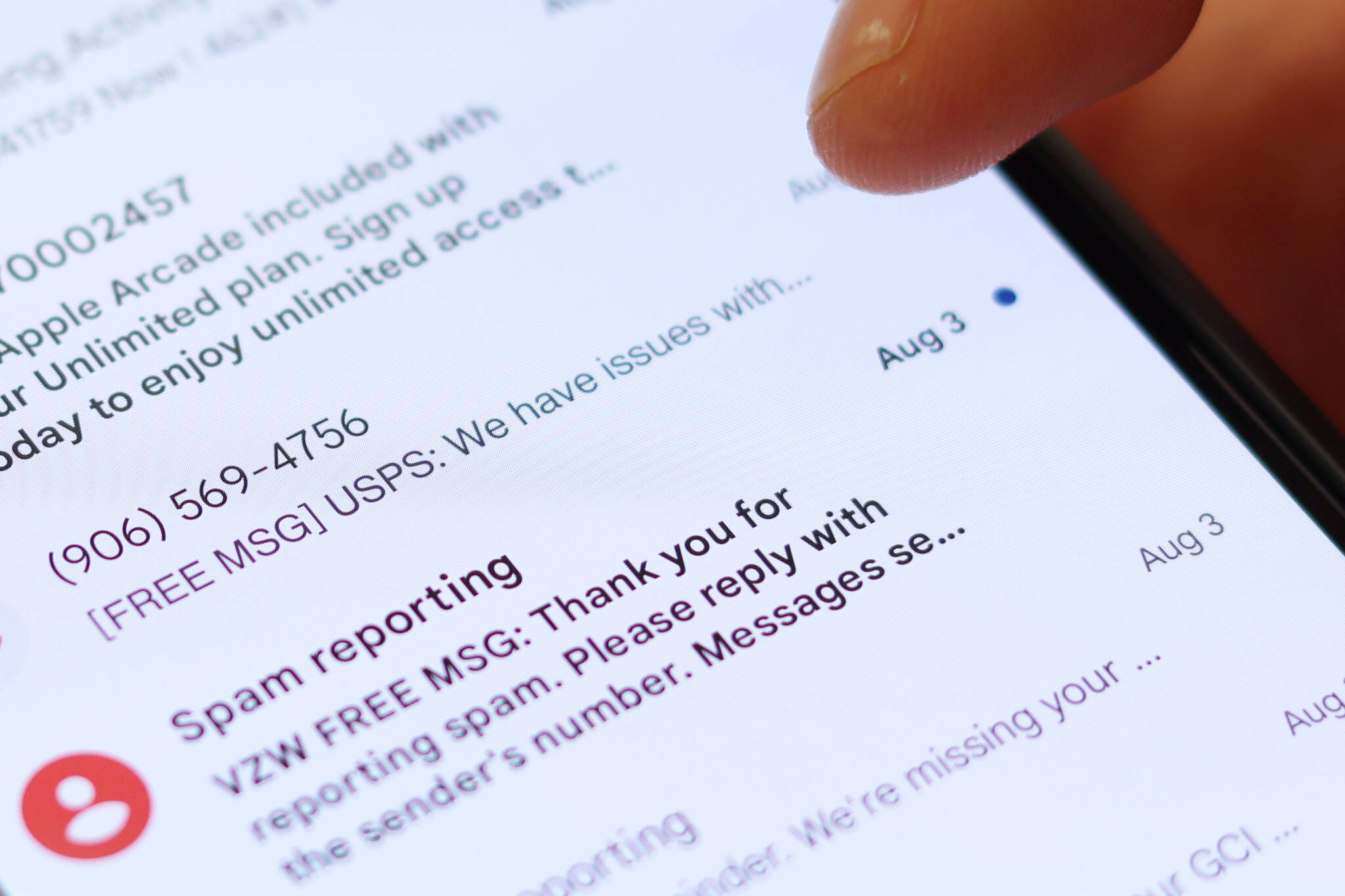

Smartphone app scams

Some apps — often disguised as games and offered for free — are designed to steal personal information, according to the FBI. Before downloading an app from an unknown source, consumers should research the company selling it, and look for reviews of the product.

Work from home scams

These scams seek to take advantage of people who would like to make extra money ahead of the holidays, according to the FBI.

The “opportunities” rely on convenience as a selling point, but may have fraudulent intentions. People should carefully research the job posting and person or company offering the job, according to the FBI.

As is the case of online shopping scams, an unbelievable offer likely shouldn’t be believed.

People should also watch out for online job postings and emails from people promising easy money for little to no effort. These can often be attempts to recruit job seekers as money mules, someone who transfers or moves illegally acquired money on behalf of someone else, according to the FBI. Common red flags include the “employer” using web-based services such as Gmail, Yahoo, Hotmail, and Outlook; asking “employees” to receive funds in their personal bank accounts and then “process” or “transfer” funds; employees being asked to open bank accounts in their name for a business; and being told to keep a portion of the money they transfer.

Gift card scam

If someone asks you to purchase a gift card for you, it may be a red flag, according to the FBI.

In gift card scams, victims get either a “spoofed” email (an email made to look like it came from someone else), a “spoofed” phone call, or a “spoofed” text asking the victim to purchase multiple gift cards for either personal or business reasons.

Charity scams

The holiday season is often a time of increased giving. That makes charity scams especially common this time of year, according to the FBI.

Scammers set up false charities and profit from people who believe they are making donations to legitimate charitable organizations. Seasonal charity scams can pose greater difficulties in monitoring because of their reach, limited duration and, when done over the internet, minimal oversight, according to the FBI. Scam solicitations may come through cold calls, email campaigns, crowdfunding platforms or fake social media accounts and websites.

These scams, according to the FBI, are designed to make it easy for victims to give and feel like they’re making a difference. Perpetrators may divert some or all of the funds for their personal use, and those most in need will never see the donation.

People who think they’ve been the victim of a scam should:

Contact their financial institution immediately upon suspecting or discovering a fraudulent transfer, ask their bank to contact the financial institution where the fraudulent transfer was sent, report the crime to law enforcement and file a complaint with the FBI’s Internet Crime Complaint Center at www.IC3.gov, regardless of dollar loss.

Trained analysts at the IC3 review and research complaints and share information with law enforcement and regulatory agencies, according to the FBI. The complaint center also collects statistics on scams and internet crime. That data is used to inform law enforcement and the intelligence community about current scams and cyber threats that need attention.

Do this and don’t get scammed

The FBI offered up the following do’s and don’ts to avoid scammers ahead of the holidays:

— Don’t open any unsolicited emails or click on any links if they do open the email.

— Do secure your banking, credit card and other valuable accounts with strong, different passwords.

— Do steer clear of untrustworthy sites or ads offering items at unrealistic discounts or with special coupons.

— Don’t respond to unsolicited emails, fill out forms contained in email messages that ask for personal information or provide credit card information when requested through an unsolicited email.

— Do check credit card statements routinely. If possible, set up credit card transaction auto alerts or check balances after every online purchase.

— Do make sure a site is secure and reputable before providing a credit card number online.

— Don’t trust a site just because it claims to be secure. Some web page addresses look similar to familiar sites but are slightly different.

— Do beware of purchases or services that require payment with a gift card or through quick payment transfer sites or apps.

— Do exercise caution with emails claiming to contain pictures in attached files, as the files may contain viruses.

— Don’t open unknown attachments from unknown senders. Only open attachments from known senders and scan all attachments for viruses if possible.

— Do verify requests for personal information from any business or financial institution by contacting them using the main contact information on their official website.

— Do pay attention to where donations are going. Only donate to known and trusted charities; legitimate charities do not solicit donations via money transfer services or ask for donations via gift cards.

— Don’t make contributions through an intermediary, and pay via credit card or check. Avoid cash donations, if possible.

— Do beware when money is required up front for instructions or products for employment.

— Do beware of people impersonating government officials and medical professionals.

By the numbers:

$6.9 billion — Internet crime victim monetary losses nearly reached $7 billion last year.

92,371 — The number of people 60 or older who reported being the victim of an internet crime was just shy of six figures. That age group was by far the most frequently victimized, losing $1.68 billion.

$13.1 million — That’s the amount Alaskans reported losing to internet crime last year. That’s more than New Mexico, Rhode Island, Wyoming, Montana, Vermont, West Virginia and Maine reported losing.

323,972 — Nearly 324,000 people fell victim to a phishing scam last year. That’s by far the most common type of internet scam.

1,787 — That’s the number of Alaskans to report an internet crime last year. That’s the sixth lowest in the nation. Alaska is the state with the third lowest population.

* Figures from the FBI’s annual Internet Crime Report.

• Contact Ben Hohenstatt at (907)308-4895 or bhohenstatt@juneauempire.com. Follow him on Twitter at @BenHohenstatt.