No, balancing the state’s budget isn’t the same as balancing your checkbook. The state, after all, can collect taxes from other people if it needs some extra money.

But narrow the thousands of line-item expenses and income to a few big things that are the main focus of debate at the Capitol, and the process is roughly similar to coming up with a spending plan for food, clothing and shelter.

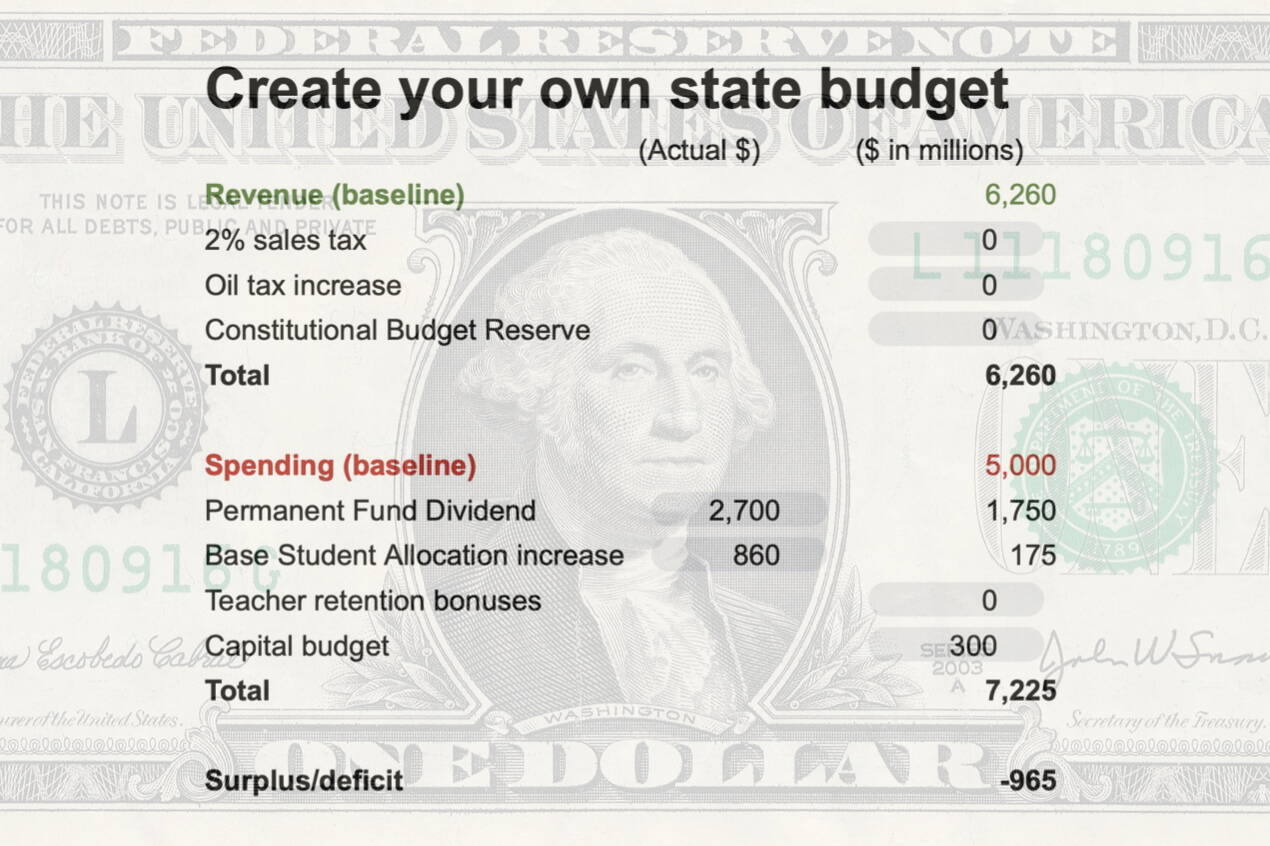

For instance, you can give the people a big Permanent Fund Dividend or lots of money for supposedly cash-starved schools. But not both. Unless you’re willing to subject your subjects to a statewide sales tax.

A chance for residents to assemble those pieces as they see fit — without worrying about nasty political realities such as getting the House, Senate and governor to agree despite their differing political leanings — is offered in the online-adjustable spreadsheet accompanying this article. While it deliberately avoids the vast complexities and range of options lawmakers will be dealing with during the month ahead, it hopefully conveys the major dilemmas they face.

Below are explanations of major revenue sources that either exist or can be added/modified, and major spending items that can be adjusted. Because the House, Senate and governor largely agree on the vast majority of items in what’s essentially a status quo budget, options to adjust those (a.k.a. doubling the Alaska Marine Highway’s funding or getting rid of 50% of the state’s administrative staff) are not included.

Also not included are some items that, while highlight issues of debate during the session, don’t appear to have a realistic chance of passing or having a fiscal impact.

Increasing public employee pensions was one of two priorities announced by the bipartisan Senate majority at the beginning of the session, for example, but Senate President Gary Stevens said Tuesday it does not appear such a change will occur this year. Similarly, an income tax bill being proposed would likely not begin collecting revenue until 2025.

Note: Items that can be adjusted in the spreadsheet are noted with an asterisk.

REVENUE

Base income: $6.26 billion

This is the official estimate from Permanent Fund earnings, oil and other income. It assumes oil prices will average $73 a barrel and, while that’s subject to wide variability that could easily swing things a billion dollars either way, it’s not user-selectable in this simulation since legislators saw such projecting is highly unwise (based on previous speculation that has at times been disastrous).

*2% sales tax: $740 million.

This is a rough estimate of a statewide tax that makes no exemptions for food or other items that often are not included in such taxes in other states. It is based on House Bill 142 that is currently being considered

* Oil tax adjustments: $540 million

This is a rough and, according to some officials, incomplete estimate of revenue that might be generated by breaks for oil companies. One of the biggest questions raised by skeptics is the assumption the tax adjustments in a bill before the Senate Finance Committee would not alter the current plans of oil companies.

* Constitutional Budget Reserve: $2.2 billion

An “easy out” patch for any remaining deficit for someone with absolute power, but much more complicated for legislators since a three-fourths vote of both the House and Senate is needed to access it. Practically speaking — for those wanting to wade into the policy-making weeds — that means the Republican-led House majority will need to make concessions to the mostly Democratic minority caucus, and the Senate majority of nine Democrats and eight Republicans will find the spending plan acceptable. For simplicity’s sake, do-it-yourselfers wanting to include an element of realism in their model can assume they can’t access this fund unless the $1,000 per-student education funding increase is included in the spending category.

SPENDING

Base expenditures: $5 billion

This is roughly the cost of a status quo state budget, not including PFDs. But while that gives DIYers a $1.26 billion surplus to start with (plus any extra revenue selected) the expenses below add up fast.

*PFDs: $1.75 billion ($2,700 PFD)

This is a “middle” number in the budget passed Monday by the House, which results in a deficit of several hundred million dollars. The governor seeking a larger “statutory” dividend of roughly $3,500 that would cost $2.25 billion and result in a deficit of nearly $1 billion. The Senate is considering a $1,300 dividend that would cost $882 million and leaves some surplus funds.

*Education funding increase: $175 million

This one-time increase in the House’s budget amounts to an 11% increase (about $860) in the Base Student Allocation for public schools. A Senate bill increases the BSA by $1,000 at a cost of $257 million. The governor’s budget contains no increase, but he is proposing the lower-cost retention bonus below. Policymakers arguing for a BSA increase state the formula remains nearly unchanged from 2017, so schools have effectively suffered a roughly 20% drop in funding due to inflation.

*Teacher retention bonuses: $57 million

This bill would provide year-end bonuses of $5,000 to $15,000 to teachers, with higher amounts for more rural areas. The governor argues it would help resolve hiring and retention issues that are part of the reason legislators are seeking a BSA increase.

*Capital budget: $300 million

This amount is an estimate by legislative fiscal analysts based on the governor’s proposed budget and discussions with lawmakers this session. A budget of at least $200 million is needed to match federal funding already approved for state projects. Some legislators seeking higher amounts — up to $800 million or more — due to the state’s widespread lack of critical infrastructure and facilities needing maintenance, which are seen as factors in the state’s shortage of workers and high living costs.

• Contact Mark Sabbatini at mark.sabbatini@juneauempire.com