NEW YORK — After weeks of vowing to raise taxes on “hedge fund guys” and high-income earners, Republican presidential front-runner Donald Trump unveiled a tax plan Monday that would cut rates across the board and reduce the amount paid by wealthiest Americans and corporations into the U.S. Treasury.

The plan, which Trump said would “provide major tax relief for middle-income and for most other Americans,” appears certain to come with a significant price tag that experts said would likely add to the national debt, despite Trump’s assurances.

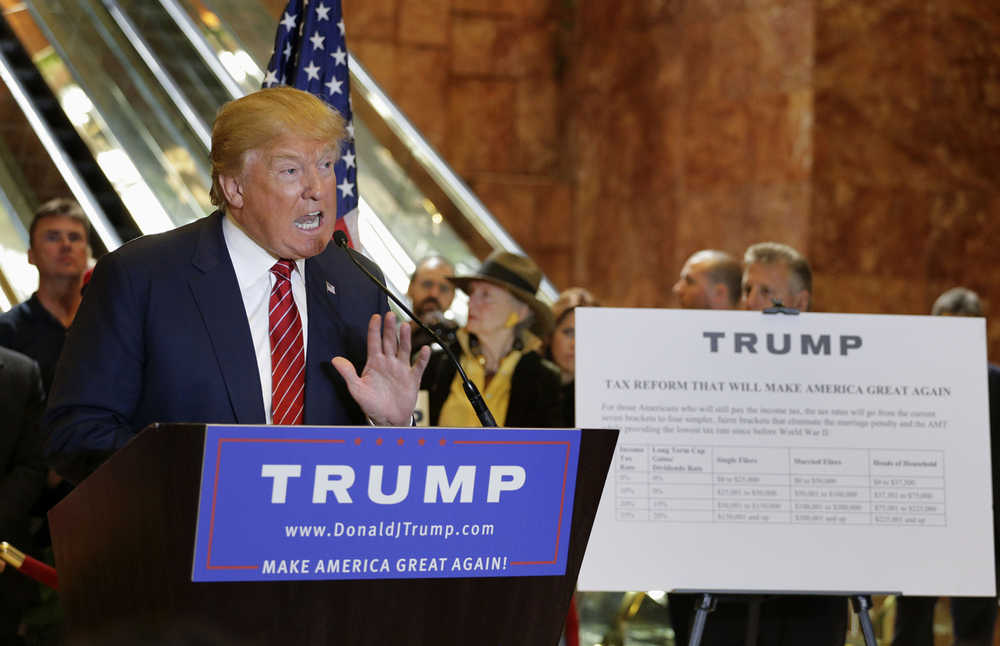

“There will be a major tax reduction,” Trump said at a news conference at his Trump Tower skyscraper in Manhattan. “It’ll simplify the tax code. It’ll grow the American economy at a level that it hasn’t seen for decades, and all of this does not add to our debt or our deficit.”

The plan Trump unveiled proposes eliminating income taxes entirely for millions of single Americans earning less than $25,000 and married couples earning less than $50,000 a year. Individuals would receive a new one-page form to send the IRS saying, “I win.”

Wealthier Americans would also see large reductions in their annual tax bill. Under Trump’s four-bracket plan, the highest marginal tax rate would be cut from the current 39.6 percent to 25 percent.

Businesses — from major corporations to mom-and-pop shops — would also see their rates slashed to no more than 15 percent, down from the current corporate tax rate of 35 percent. Trump also said he would eliminate the estate tax.

The billionaire real estate mogul said he plans to pay for the tax cuts by eliminating and reducing unspecified deductions and loopholes, both on the “very rich” and corporations. He also wants to eliminate the so-called carried interest loophole that allows managers of hedge funds and private equity firms to pay a lower tax rate than most individuals.

“In other words, it’s going to cost me a fortune,” Trump said.

Tax experts rejected that analysis. Steve Gill, a tax and accounting professor at San Diego State University, said his quick calculation found that as a group, Americans making more than $200,000 a year would pay $400 billion to $500 billion less in taxes under Trump’s plan.

“This is not a serious plan,” said Michael Strain, a resident scholar at the conservative American Enterprise Institute in Washington. “He strongly indicated in television interviews the rich wouldn’t like this plan. The rich love this plan.”

Kyle Pomerleau, an economist at the Tax Foundation, which advocates for lower rates, said Trump’s tax cuts are far larger than those proposed by any other Republican candidate and could easily cost more than $7 trillion over the next decade. That’d be double the cost of the proposal from former Florida Gov. Jeb Bush.

“It looks mostly like Bush’s plan, except it is a much, much larger tax cut,” Pomerleau said. “The Trump tax cut is bigger than what we’ve seen so far from Republican candidates.”

Trump said the changes he wants to make to the U.S. tax code would not add to the annual federal budget deficit and the overall national debt, in part because his plan would bring in new sources of revenue to the Treasury.

Among them: a one-time tax of 10 percent on money corporations are holding overseas that is brought back to the U.S, and the elimination of the ability of companies to defer taxes on income earned overseas. Estimates peg the amount of money U.S. firms have overseas at more than $2 trillion, although Trump said he believes the figure is far higher.

Trump also predicted his plan would “create tremendous numbers of jobs” and spark the economy to grow at least 3 percent a year, and as much as 5 or 6 percent. “We’re going to have growth that will be tremendous,” he said.

Most economists say such a high growth rate is unrealistic. But even under the most optimistic scenarios for growth, the size of Trump’s tax cuts will keep the government from raising as much revenue as does the current tax system, said Ryan Ellis of Americans for Tax Reform, a low-tax advocacy group that Trump consulted as he developed his proposal.

“It just doesn’t square up,” Ellis said, even as he praised the proposal for lowering tax rates.

Gill said no amount of eliminated deductions would be able to make up for the large amounts of money top earners would no longer pay in taxes under Trump’s newly lowered rates.

“You can’t make that up in any way other than shifting the burden to the middle class” or running deficits, Gill said.

In fact, he said, some isolated taxpayers could pay more. For example, if Trump eliminates the deduction for medical payments, certain households with high hospital bills could find themselves owing more money despite lower overall tax rates.

Trump said he would couple his tax plan with savings from cutting wasteful government spending, by renegotiating trade deals and demanding reimbursement from America’s allies for the cost of U.S. military protection. He vowed his administration “will be balancing budgets and getting them where they should be.”

The Congressional Budget Office projects this fiscal year’s federal deficit will be $426 billion, meaning Trump would need to find that much in potential spending cuts if his tax plan was revenue-neutral in order to balance the budget.

“We are reducing taxes, but at the same time if I win, if I become president, we will be able to cut so much money and have a better country,” he said.

___

Riccardi reported from Denver, Colorado.

___

Follow Jill Colvin and Nicholas Riccardi on Twitter at http://twitter.com/colvinj and http://twitter.com/nickriccardi.