Alaska’s credit rating hasn’t been downgraded again — yet.

Moody’s Investors Service issued a report Thursday reiterating that it has not forgotten about the state’s money troubles.

The report immediately notes that the Legislature adjourned July 18, when the Senate gaveled out following the House’s wrap-up a few days prior, without progress in addressing the multibillion-dollar budget deficit.

“The failure to devise a sustainable fiscal structure is credit negative and means that for at least another year, the state will keep burning through its still-ample reserves, which were accumulated during years of high oil prices,” Moody’s analysts wrote.

The trio of major U.S. ratings have all downgraded Alaska from formerly sterling ratings in 2016 to AA+ with a negative outlook, citing the state’s shrinking savings and remaining budget gap.

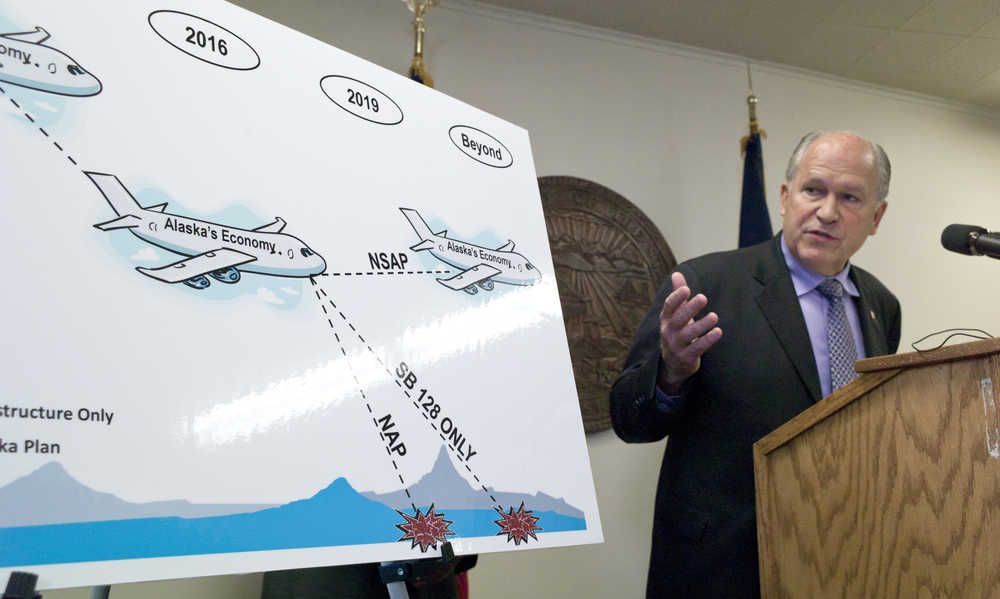

Gov. Bill Walker said during a speech to the Matanuska-Susitna Borough Assembly July 19 that he was told that day “Moody’s is holding an immediate meeting on the bond rating in Alaska; it was originally scheduled for the 9th of August; it’s been scheduled for this week,” the governor said.

While the Thursday informative report from Moody’s did not follow a ratings downgrade, the ratings agencies have indicated they would be forced to move Alaska further down the credit ladder if some sort of budget solution was not reached during what ended up being a marathon 2016 legislative session.

The report references the $4.4 billion 2017 fiscal year budget passed by the Legislature, which when combined with $1.2 billion in expected revenues, left a $3.2 billion deficit. Walker vetoed $1.3 billion in budget spending before signing it late last month, resulting in a much smaller deficit — for this fiscal year at least.

“Alaska Gov. Bill Walker has proposed a fundamental structural overhaul of the government’s fiscal operations to a sovereign wealth fund approach. Under his proposal, the General Fund would be funded (partly) by investment income from the state’s $54 billion Permanent Fund,” Moody’s wrote. “This plan carries it’s own risks and uncertainties. However, the lack of a plan is riskier and more uncertain.”

Additionally, Moody’s echoed what Revenue Commissioner Randy Hoffbeck has said repeatedly, that the lack of a long-term fiscal plan would require severe spending cuts — reducing the 2017 budget amount by as much as two-thirds — once the Constitutional Budget Reserve is depleted within a couple years.

Some legislators have commented that a state budget that size would be appropriate, given state revenues have fallen along with oil prices by 80 percent over the past two years.

A June 20 Moody’s report calculated that oil prices as high as $60 per barrel, while they are in the $45 per barrel range currently, would still cause Alaska to run out of savings in 2022 absent sharp spending reductions or new revenues.

“We still believe the state will eventually come up with a sustainable solution rather than resorting to draconian cuts to vital public services. However, in the meantime its reserves are shrinking and there is little visibility into when its reserve draws will be abated,” Moody’s observes.

• Elwood Brehmer is a reporter for the Alaska Journal of Commerce. He can be reached at elwood.brehmer@alaskajournal.com.