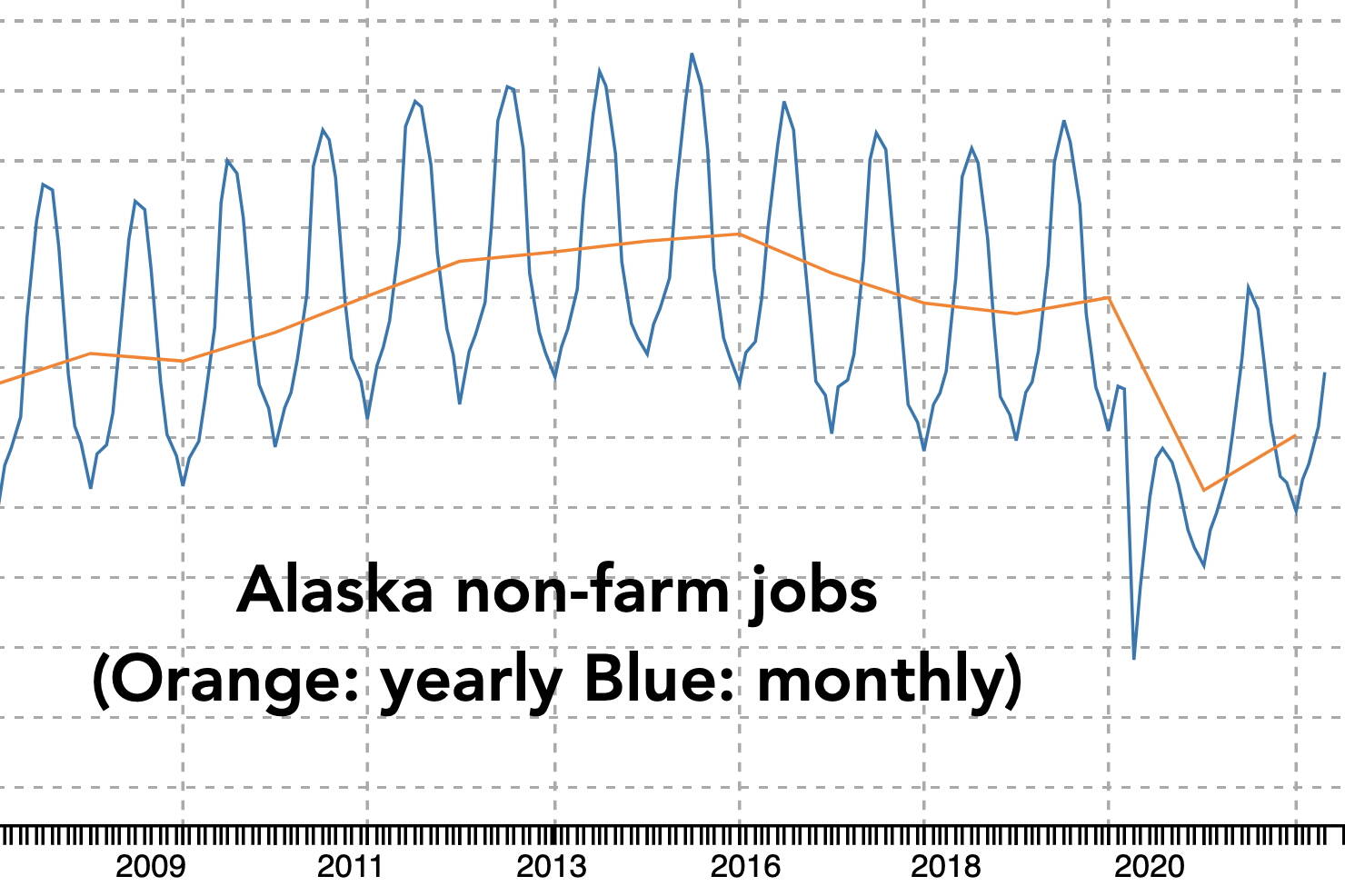

The state has more jobs and less oil revenue, according to reports released this week, and somehow both are signs of a continuing slow return to pre-pandemic normal.

July’s statewide job numbers were 3% higher than a year ago, continuing a trend that has seen smaller increases of roughly 2% in per-month comparisons. But Dan Robinson, research chief for the state Department of Labor, said the higher July increase is due largely to “a partial return to normal this cruise tourism season” and it’s unknown if the rate of growth will continue.

“When we get to October through December we will obviously have a much better sense of how our overall economy is doing,” he said Friday.

More significantly, Robinson said, job totals remain well below pre-pandemic numbers in 2019. Alaska had about 9,900 more non-farm jobs last month than in July of 2021, but it was still about 14,000 less than in July of 2019.

Similarly, while Southeast Alaska employment numbers were better than the statewide averages, with 39,000 this July compared to 37,100 a year ago (slightly more than a 5% increase), Robinson said the region’s higher cruise ship activity is largely the reason. The region had 42,900 jobs in July of 2019.

A notable downtrend for Southeast Alaska since the pandemic is state employment, Robinson said. But not all of it is attributable to efforts by state lawmakers to trim bureaucratic budgets.

“One thing to remind ourselves is that the university is part of that level,” he said.

There were 4,100 state government jobs in the region this July, 4,300 in July of 2021 and 4,600 in July of 2019, according to the latest labor department report.

Other industries showing statewide gains in the July report were the trade, transportation and utilities sector as well as construction. The latter, along with wholesale, education and health, were categories where statewide employment exceeded 2019 figures.

The statewide seasonally adjusted unemployment rate was 4.5% in July, compared to the nationwide rate of 3.5% percent.

But while more people have jobs and huge headlines are proclaiming they’re paying less for gas than a month or so ago, the latter isn’t good news for the state’s budget coffers.

An updated forecast last week from the state Department of Revenue projects oil revenue will be $1.4 billion less for the current fiscal year than predicted in June. That’s based on futures prices of $94.39 a barrel, compared to a peak of $128 in June shortly before Gov. Mike Dunleavy signed the state budget for the fiscal year that began July 1.

The revenue forecast has shifted back and forth significantly since March, according to Joe Felkl, the Department of Revenue’s legislative liaison and public information officer. June’s revenue forecast was $706.5 million higher than the spring forecast and the most recent projection is $715.5 million less than March’s estimate, resulting in the $1.4 billion total decline from the estimate just before the budget was signed.

“Oil prices are inherently volatile, and there is always a level of uncertainty around oil price forecasts,” Felkl wrote in an email this week. “This uncertainty is part of the reason that DOR has begun providing monthly revenue updates in addition to our twice-annual official forecasts.”

In practical terms, the biggest impact is how much the state “forward funds” schools a year ahead of time. During the signing of the state budget, Dunleavy and senior budget officials said full forward funding will happen with oil prices of $102 a barrel or higher, partial forward funding will happen between $87 and $102, and the state will fall into deficit if the average price falls below $87.

“Based on statistical analysis of options markets, a drop in price to $50 would be highly unlikely (below the 10th percentile of possible prices, as of the spring 2022 forecast),” he wrote.

• Contact reporter Mark Sabbatini at mark.sabbatini@juneauempire.com.