By Ken Koelsch

Inflation is at a 39-year high and the local price for lettuce is over $5 a head. How can the City and Borough of Juneau lower our cost of living? Stop over-collecting taxes and return the over-collection.

Before serving as mayor for almost three years and on the Juneau Assembly for six, I taught in the Juneau school system for almost 30 years. I often encounter former students and others I met when running for or serving in office. These citizens form the backbone of Juneau’s working middle-class families.

The CARES Act in 2020 and the American Recovery Act funds in 2021 provided a much needed and, in some cases, truly life-saving net for many sectors of Juneau’s population and businesses; however, many working-class and middle-class families were left out.

For several years, Juneau has consistently ranked as the most expensive urban area in Alaska for housing, groceries and medical care. The current spike in inflation just adds to the challenge of raising a family and maintaining a home here. A recent article in the “Washington Post” pointed out the 7% increase in inflation is the largest annual increase in years; as a result, Americans are spending more on necessities; beef is up 20%, fish 8%, chicken 10%, pork 15%, eggs 30%, clothing 6%, furniture 17%, new cars 12%, used cars and truck 37% and housing up 13%.

Over the past few weeks, I asked residents I encountered the same question: “If property and sales taxes were lowered and you could keep more of your income, how would you use the money?”

Here are some of the responses: Pay more on my mortgage, fix appliances or buy new ones, braces for my kid’s teeth, fly south to see my parents, eat out at a restaurant on special occasions, donate to food banks or shelters, upgrade to a newer and more reliable transportation, increase our giving to church, save it for when it’s needed, get a pass to the pool, extra payment on my student loan, pay off a credit card.

The CBJ has been growing its financial reserves by over-taxing its residents. In CBJ’s “Rainy Day” Restricted Budget Reserve, the amount of $15,600,000 by itself is sufficient and so far, has not been tapped. The Unrestricted General Fund Balance, however, has $22 million in it when four to six million should be an adequate amount. High unrestricted general fund reserve fund balances tend to attract many one-time funding requests from special interest groups inside and outside the CBJ. Operational costs can also fall back on this surplus revenue. This is not sound fiscal policy.

FY2021 (through this past June)

— Unrestricted general fund balance = $25,553,900

— Restricted budget reserve = $14,600,000

—Unrestricted + Restricted reserves = $40,153,900

FY2022 (projected through next June)

— Unrestricted general fund balance = $22,768,393

— Restricted budget reserve = $15,600,000

—Unrestricted + Restricted reserves= $38,368,393

Significantly lowering the amount of property tax we pay would help working families.

Last year, while the millage rate was lowered, the property assessments were in general raised higher, resulting in a net increase in the amount of property tax each property unit paid. Commercial property assessments went even higher than personal property. Didn’t we try to save many of these same businesses with CARES and American Recovery Act and Norwegian Cruise Line funds these past two years? This year, property assessments will again be higher borough wide. A millage rate that would actually lower property taxes significantly would help working class family budgets and the businesses we are trying to support.

Another tax in need of revision is the “temporary” 1% sales tax. Let it truly be temporary and let it expire on Sept. 30, 2023, instead of over-collecting from the taxpayers.

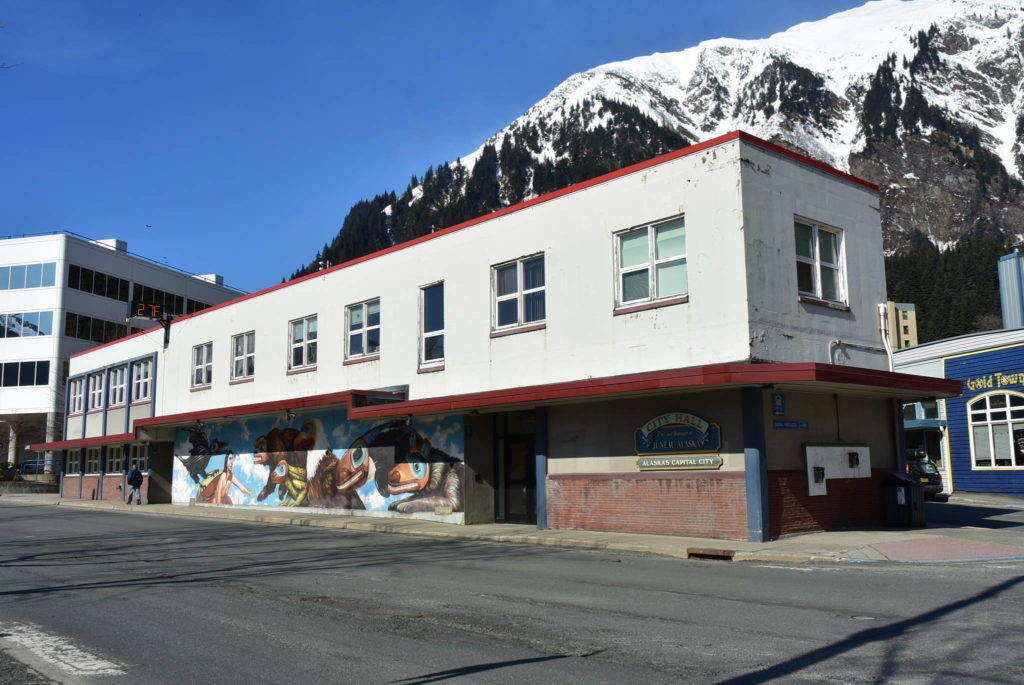

Working families pay their fair share of taxes to support our local government. When the streets go unplowed, the CBJ cites “budget cuts” but then plows $2 million for a 30% completed design study of a concept for a $77 million Capital Civic Center. Inflation and taxes are real and are affecting our Juneau families. Reducing the tax burden to working class families should be a priority we can all get behind.

It is time for the CBJ to stop over-collecting from residents and give money back to the individuals and businesses they took it from.

• Ken Koelsch was a teacher at Juneau-Douglas High School 1969-1996, port director for U.S. Customs and Border Protection 1996-2014, served on the CBJ Assembly 1997-2003 and served as mayor 2016-2018. Columns, My Turns and Letters to the Editor represent the view of the author, not the view of the Juneau Empire. Have something to say? Here’s how to submit a My Turn or letter.