We’ve been thinking a lot about Ronald Reagan this week.

We’ve also been thinking about William Jennings Bryan.

Back in 1980, when Reagan became president, he promoted the idea of trickle-down economics. It’s the notion that if you cut taxes on the rich, they’ll invest their newfound savings. Businesses will have more money for expansion and higher wages, so the tax break gets passed down to everyone in the country.

It wasn’t a new idea.

Back when William Jennings Bryant was running for president as a Democrat in 1896, his Republican rival, William McKinley (whose name was attached to a mountain around here) had the same idea.

Bryant didn’t buy McKinley’s theory. Bryant’s allies referred to McKinley’s idea as the “horse and sparrow theory.”

If you feed a horse enough oats, some of those oats are going to pass through the horse and become food for the sparrows.

That analogy’s been rattling around this week as we watch the U.S. Senate move toward a vote on a sweeping tax cut for the rich. Sure, there’s some cuts for us sparrows, but most of the oats are going to the horses.

We’re looking at a tax bill that will cost federal taxpayers more than $1.4 trillion over the next decade. Most of that money will go to people making more than $100,000 per year. Both figures come from the nonpartisan Congressional Budget Office.

U.S. Sen. Dan Sullivan, R-Alaska, points out that tax cuts will boost the nation’s economy, and we don’t argue with him there. We’d simply point out that the boost doesn’t in any way equal what this tax cut will cost. Horses eat a lot, after all.

According to Congress’ own Joint Committee on Taxation, the boost is only equivalent to about $400 billion over the next decade. That leaves Americans $1 trillion in the hole.

Sullivan thinks there will be a bigger boost, but he hasn’t shared his figures.

We’re not opposed to federal spending or federal deficits, but we are opposed to them when we think they’re wrongheaded.

For the cost of this tax bill, you could give every American household (all 126 million of them) $1,000 per year for a decade, and provide free college tuition for every high school student during that decade.

You could fund a universal national healthcare system. You could buy 26 Mars missions under NASA’s current funding schedule.

You might even be able to pay for a year of the War on Terror.

This bill isn’t all bad, of course.

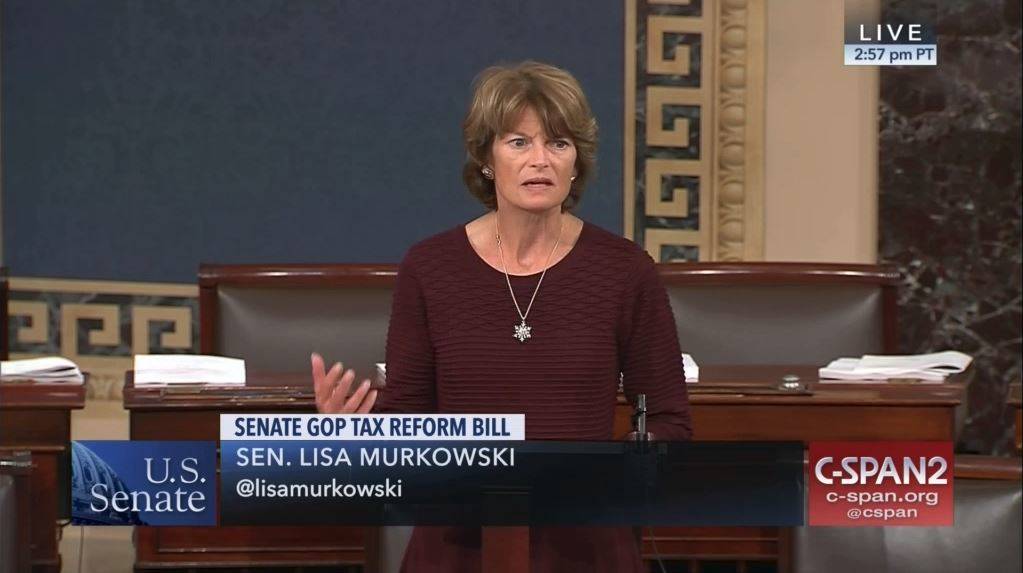

Sen. Lisa Murkowski, Alaska’s senior U.S. senator, did a nice job inserting a pro-Arctic drilling provision into the tax measure, and it’s an idea that would benefit Alaska significantly.

The problem is that Murkowski’s effort is frosting on a much larger cake. Now that we’ve seen what the cake is made of, you’ll have to forgive us if we don’t take a bite.